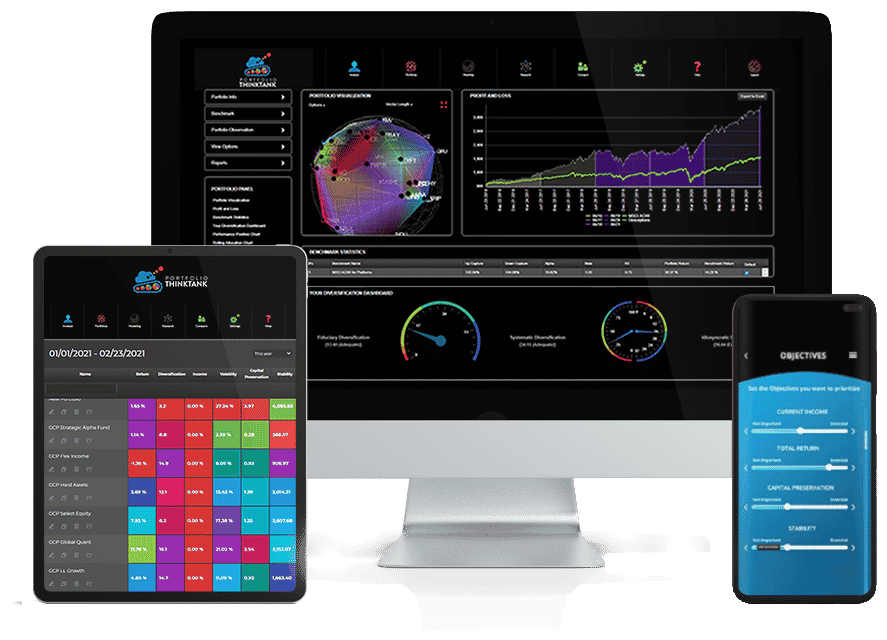

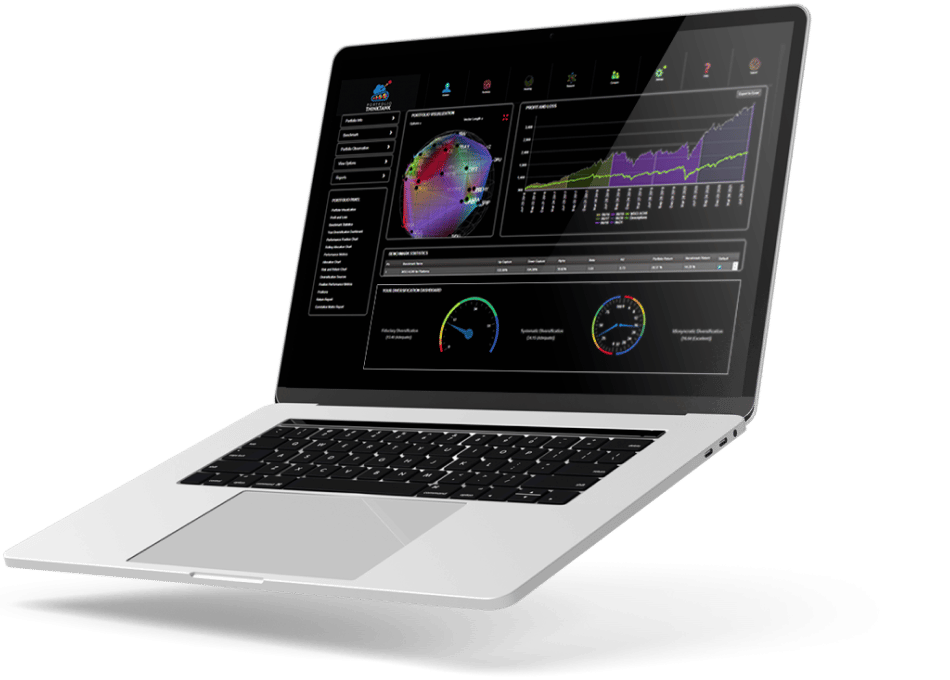

Modernize your Portfolio Construction.

Asset allocation is breaking out! We combine industry-leading portfolio optimization, full-strategy design, and backtesting with beautiful charting and analytics, all rooted in the science of diversification we pioneered. It is time to extend the conversation about risk and return to risk and diversification. You will construct better portfolios using our diversification measurement,

visualization, and optimization. You will expose hidden and uncompensated dangers and inferior or negligent diversification. You will be a rockstar with your investors.

All Paid Plans With Unlimited Phone and Email Support

Fully cancelable anytime. If canceled before the renewal date, all data is fully upgraded to enterprise versions with support for your website portfolio builder.

FEATURES

Core Features

Optimization Policies

Reports

Marketing

System Overview

Data

Support & Training

Advanced Features

Core Features

- Risk Analysis

- Diversification Analysis

- Diversification Measurement

- Portfolio Reports

- Website Embedded Portfolio Analysis

- Custom Benchmarks

- Portfolios of Portfolios

- Automatic Rebalancing

- Automatic Stop-Loss Risk Protection

- Global Security Database

- Performance Analysis

- Diversification Optimization

- Risk Profiling

- Comparison Reports

- Website Embedded Portfolio Views

- Export to Excel

- Monte Carlo Simulation

- Automatic Re-Optimization

- Short Selling

- Benchmark Analysis

- Portfolio Visualization

- Factsheets

- Custom Branding

- Portfolio Recommendations

- Import Your Own Assets

- Automatic Monitoring

- Constraints

- Captial Market Assumptions Engine

Optimization Policies

- Risk & Return Estimation Floor

- Custom Shrinkage Targets

- Fixed or Rolling Samples

- Risk and Return Manual Forcasting

- Selectable Risk Definitions

- Stop Loss Based on Standard Deviations

- Fee Modeling

- Threshold Constraints

- Automatic Profit Taking

- Risk & Return Estimation Ceiling

- Downside Diversification

- Custom Sample Weighting

- Risk and Return Forcast Blending

- Global Stops Loss

- Absolute Stop Loss

- Min and Max Postion Constraints

- Global Constraints

- Shrinkage (James / Stein Estimation)

- Multi-Sampling

- Risk and Return Forcast Importing

- Custom Hurdle Rate

- Stop Loss %

- Simulation / Resampling

- Group Constraints

- Rounding Policy

Reports

- Profit & Loss Report

- Risk & Return Charts

- Risk Table

- Allocation Chart

- Asset Performance Spark Charts

- Custom Disclosures

- Upside & Downside Capture

- Benchmark Statistics

- Factsheet Builder

- Correlation Matrix Report

- Positive Performance Chart

- Diversification Dashboard

- Performance Vs Benchmark

- Rolling Allocation Chart

- Report Customization

- Alpha, Beta, R2 & Yields

- Stacked Profit and Loss Chart

- Interactive Gsphere Graphics

- Return Table (Calendar, Trailing or Exact Date)

- Diversification Source Chart

- Advanced Quantitative Data

- Risk & Return Bubble Chart

- Custom Glossary

- Systemic Risk Measurement

- Excel Exports

Marketing

- Website Embedded Portfolio Analysis

- Custom Branded Reports

- Website Embedded Portfolio Views

- Document Access

- Custom Branded Portal

System Overview

- Risk and Return Forcast Logging

- Max Portfolio Positions

- Custom Folders

- Partial Optimization

- Ticker Lookup

- Notifications

- Saving & Retrival of Policy Trees

- Team and Prospect Sharing

- Investor Questionaire

Data

- US Exchange Traded Stocks

- Exchange Traded Funds / Closed Funds

- Bring Your Own Excel Data

- Mutual Funds

Support & Training

- Live Chat Support

- Basic Training

- Video Training

- Email Support

- Advanced Training

- Optimization Consulting

- Web Support

- Priority Support

Advanced Features

- Portfolios of Portfolios

- Short Selling

- Quant Stats

- Stop Losses

- Profit Taking

AS FEATURED IN

USE CASE

- Analyze Any Portfolio

- Create a Proposal

- Compare Portfolios

- Score Portfolio Diversification

- Advice and Educate Investors

- Differentiate Your Business

- Optimize a Portfolio

- Create Model Portfolios

- Create a Custom Portfolio Strategy

- Systematize Any Strategy

- Curate and Log Buy Lists

- Document Your Investment Process

- Backtest a Strategy

- Test Portfolio Variations

- Engage Investors Online

- Core - Satellite Strategies

- Overlays

Portfolio ThinkTank Optimization Suite for Advisors

$300

$50/Month

FIRST MONTH

*Cancel at any time with no commitment